OUR PHILOSOPHY

Flexible Standardised Processes

Covering the changing Directives into Regulations so you can easily comply.

The close relationship and collaboration between the EU, CEPI and OptimaSys allows for smooth and rapid implementation of fast changing requirements that are converting soon into a European Union-wide Regulation to be implemented by all member states.

The upcoming European Electronic ID will be intergrated into Immosurance, the moment it becomes available. Electronic identification of persons within Europe will allow for a safer and smoother process with your clients.

CEPI & European Union

CEPI is committed in its relation with the European Union on Anti-Money Laundry & GDPR laws, to provide clarity on the ongoing changes in the laws and the practical application to the Real Estate industry.

Practical Tools

Putting law into practice by providing practical tools that cover the vast majority of elements described in the laws, applied to Real Estate, so that businesses can rely on one central solution that's flexible enough to adapt to country-specifics.

Implementation

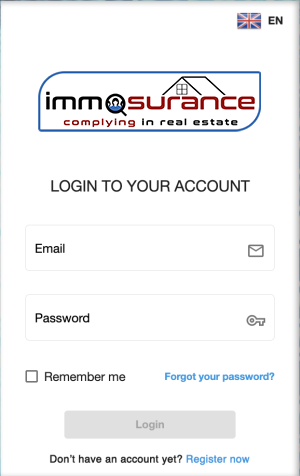

Immosurance is a multi-lingual platform by CEPI's digitalisation partner OptimaSys, known for its international Optima-CRM platform. Advanced technologies deliver a user-friendly and totally secure process-driven solution enabling total compliance.

Secure Integration

Enabled by open API's (Application Programming Interfaces) allows for the users' CRM systems to integrate seamlessly making it a natural extension to the usual environment of the business.

Global Strategy

By design, Immosurance can be applied anywhere in the world as it deals with universal principles and laws on financial transactions. The built-in flexibilities allow for easy adaptions of use.

Sharing Responsibilities

Clients are involved in the process of identifying the risks in a transaction. Immosurance provides tools which moves the gathering of information to the client so that the Real Estate business can focus on the risk evaluation and exceptions.

Secure Platform

Immosurance is a secure platform similar to the awardwinning CRM for Real Estate Optima-CRM.

Process-driven guiding you from start to finish identifying & documenting the risk of each of your clients.

All in Your Language

Working in your own language (or one of your preference) makes it easier to comply with laws and regulations. Add to this that documents & communications are generated in the language relevant to each client & country.

WORK PROCESS

Logical Process with Client-Generated Info

You decide to initiate the process and create the basic information of the client in the platform, whether entered manually or via the automation through API from your CRM system. This automatically invites the client to enter information in a unique input area that’s client-specific by validation token.

The Client self-assesses their situation and provides the required information and supporting documents are uploaded.

Based on the submitted input by the client, you now review the results of the risk assessment, completeness of documents, and correct or supplement where required. Here you are informed what the potential risk is, comment any specifics or obtain additional information from the client which is then added to the record by either the client or yourself.

Once all the information is collected satisfactory, now it’s the client who review it and signs it electronically which is your legal proof that the information and ID of the client are genuine, and thus you comply with all the requirements of the due diligence process.

In some cases, you may have repeat business with an existing client, for another transaction, whereas you then do a follow-up process to update the record with the information of the new transaction.

Solution

Driven

Technologies

by CEPI and the European Union

Enriched by

Artificial Intelligence

Reducing the workload of Real estate Professionals